Accounting in China is different than international accounting standards. Like many financial services in China, this can present a challenge for international companies. This article summarizes WFOE accounting duties, while focusing on bridging the gap between Chinese and international standards.

Accounting in China

WFOE’s financial duties

Once the WFOE registration process is completed, and the company has a business license in China, it is obligated to fulfill two main financial duties:

- To document all financial activities and keep legally validated accounting reports, which are submitted periodically with the local tax office.

/ - To undergo an annual statutory audit (including filing reports at SAFE), which serves as a prerequisite for profit repatriation in China.

Needless to say, failure to comply with these requirements and specific local accounting regulations will be penalized.

Chinese vs. international accounting standards

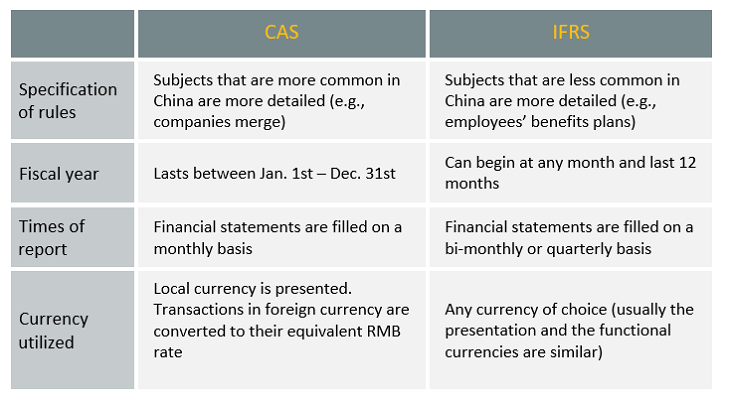

The market-oriented accounting concept in China is relatively new, as China reformed its traditional socialism-oriented accounting standards only in the beginning of the 2000’s. Yet, in spite of the increasing alignment with International Financial Reporting Standards (IFRS), the Chinese Accounting Standards (CAS) are still slightly different in some areas.

Unstandardized accounting standards

The challenges of discrepancies

The difference in accounting standards usually comes into play when HQ asks the Chinese subsidiary to produce and deliver financial reports. The process of translating CAS documents and adjusting them to the IFRS used at the parent company’s books is called Mapping.

Large and well-off international companies often use specialized software to fulfill this mission. However, SMEs and short-in-budget companies have to execute the conversions manually. As a result, when it comes to WFOE accounting, they usually hire a local experienced and reliable third party to manage their books.

At PTL Group, we specialize in financial and accounting services in China. Get in touch today and let us support your China operations.

Last updated: Apr 2024